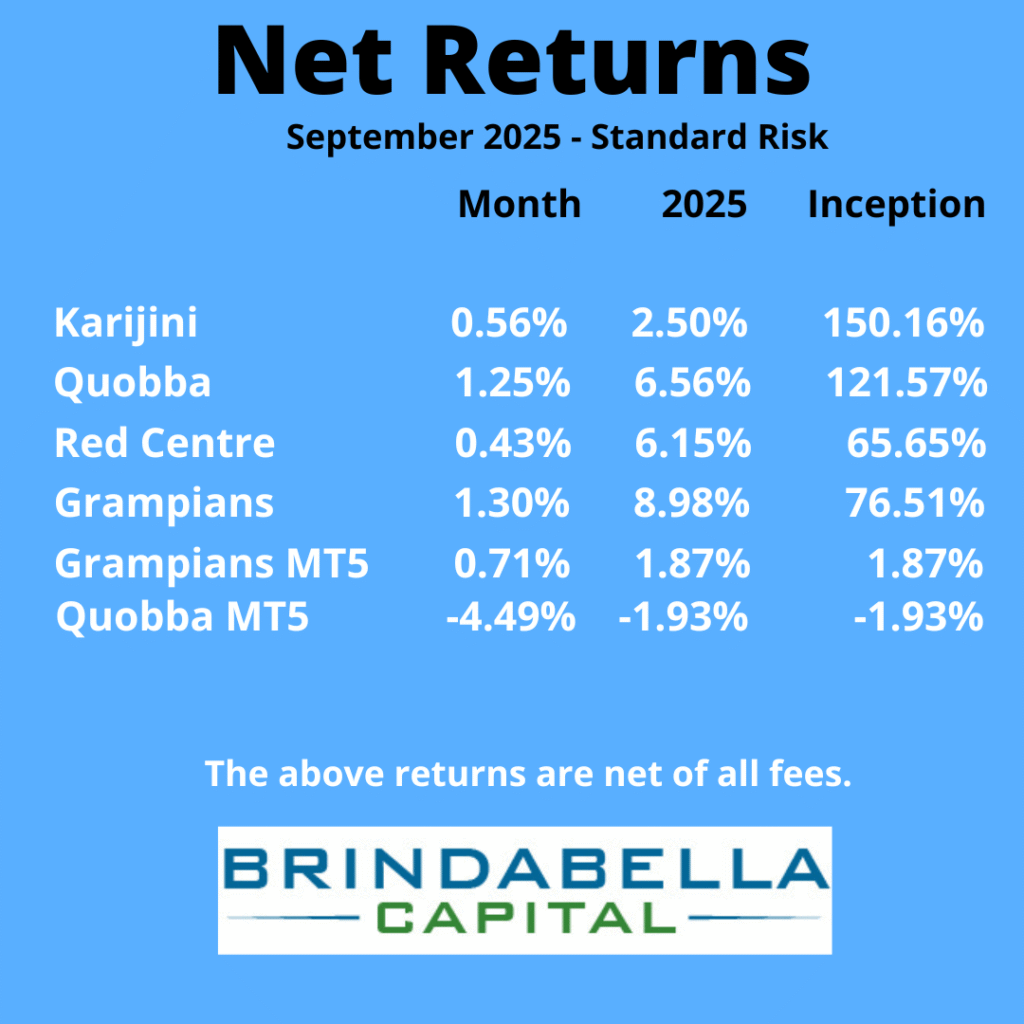

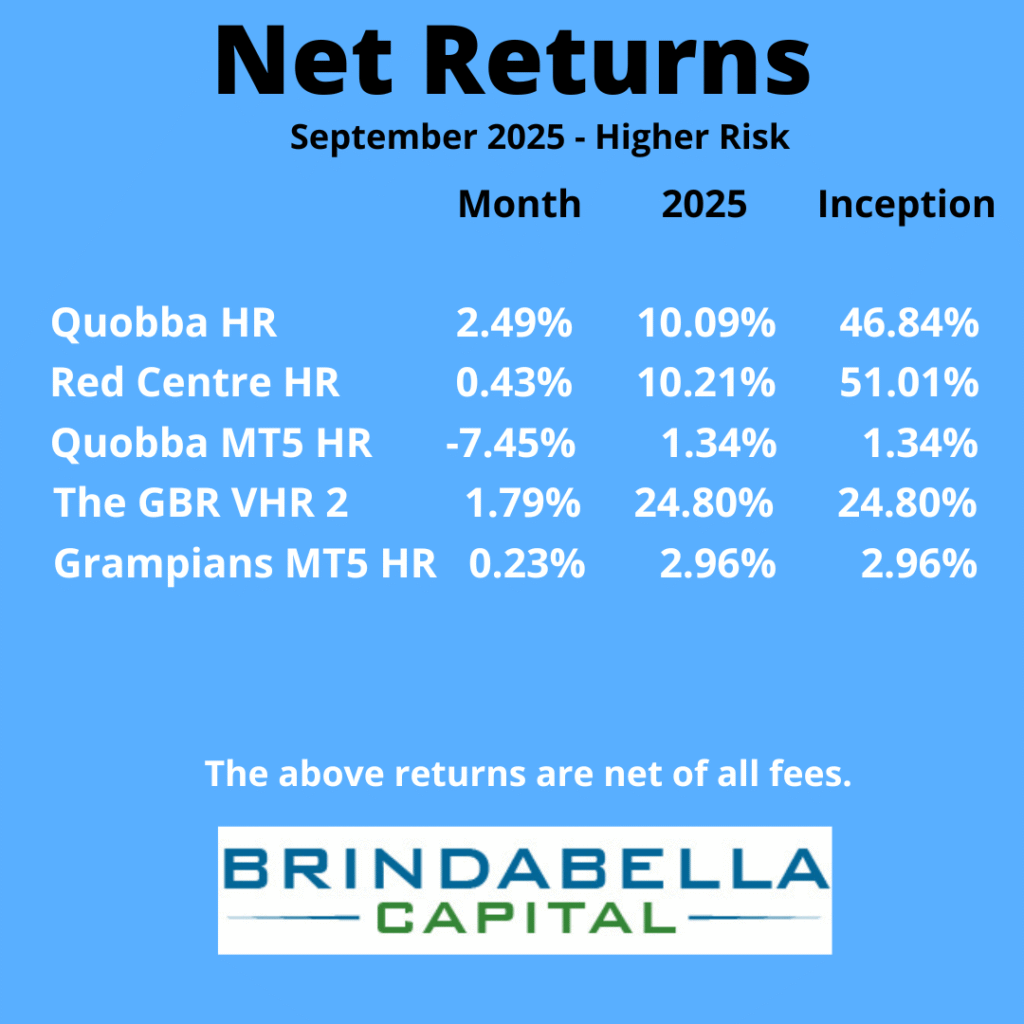

Please find below the net returns for September 2025.

Last month we flagged the pressure was building but was unsure when the market would release it.

Well, it came sooner than we thought with September the time for markets to have a large and quick run up or down is certain currency pairs.

For our strategies it was AUDCAD and NZDCAD. Per the message sent out earlier in the month, for 5 days AUDCAD had risen from 90.200 to 91.800 and soon after went to 92.200. It happened all so quickly after a poor job report and expectation of a larger interest rate cut in the US and overall, a large overaction to the news. The market trading did not match the level of news.

Further to this there was no wave action. For AUDCAD it was just kept going up every day for 7 days straight and then hovered and bounced around a little as it waited for more news. As anticipated the first news was an overaction so there was drops for the next 5 days in a row and cleared our open sell positions.

From our strategies point of view the new MT5s had large draw downs. This was due to all the bots on the strategy trading at the same time due to the large upward wave so it expected a swing back which did not occur. All bots do not normally trade but the over reaction in the market set them all off to open correction position too early.

Further on the MT5, we had all the bots trading independent to each other where we normally have them check if another bot is trading before they open a trade. Reason for this was due to low volatility for the last 4 months so we wanted to build some returns. As such they experienced heavy draw downs and required manual intervention. We also had stop losses occur, which is the purpose of why they are there, but this led to losses on Quobba MT5 strategies.

In addition, we had some investors lose their capital of GBR MT5 Very High Risk with a minimum balance of $1,000. Whilst our account was able to trade through it, it was solely due to previous months of profits on our trading account whilst new investors only just had close to the $1,000. But ours did come close. We never want investors to lose their capital so we will revisit the minimum required for this strategy.

September has helped us a lot with our MT5 strategies and as such we need to rebuild them again so they will be taken offline and will start them again once ready.

Overall, our strategies manage conditions well.

Any queries, please do not hesitate to reach out.